Since our annual 2019 report for nonprofits, commentary from our practice leadership continues to have relevance and perhaps even greater meaning as time goes on. We have witnessed carriers and excess liability reinsurers reduce limits overall, and in some cases put a price on layers that are multiples of the past. We continue to advocate for the third sector to protect their respective missions, reputation and sustainability, as we pivot from a single mindset of transfer of risk to holistic engagement of data analytics, jurisdictional context, duty of care, transparency, credentialing and defensibility.

In many instances, discussion of liability limits start at the Board level. Often the initial inquiry is about directors and officers (D&O) limits. How times have changed in 2021, as we have witnessed a challenging market across the world, a pervasive pandemic and stress across all economies.

We are clearly seeing the value of data in all of our planning and outcomes, something we value in the insurance industry. But we tend to look backwards, at data about how nonprofits managed their management liability exposures in the past. Is the past a reflection of what we face ahead? This question is big, given that nonprofits must navigate a growing litigious environment in the future, as well as a growing body of experience and knowledge.

Think of all the moral failure that has rocked the nonprofit world over the past 20 years, especially sexual abuse and molestation (SAM) occurrences. And it just keeps coming — primarily due to the latent nature of the exposure and the growing impact of social media. It appears that proactive, transparent nonprofits that recognize these maladies and deal with them in a mission-orientated way (as an example, search the web for "voluntary compensation program") are actually incurring less loss through mediation, arbitration and advocacy for those allegedly harmed — and no dollars to litigation attorneys.

We must not just look back; it is a new day for nonprofits and public-serving organizations. We will always be held to the highest standards of care, and we have all kinds of tools to follow these evolving stands, so there are no excuses for negligence or lack of accountability. And ultimately, this responsibility will reside with governance — the Board of Directors.

So as you deliberate what limits are appropriate, reasonable and even affordable, focus on actions your nonprofit can take to demonstrate its vital role in community safety and wellbeing. With shrinking capacity and pricing escalation on excess liability limits in particular (especially SAM exposure), we just may be unable to afford the pricing for excess limits.

Based on the highly nuanced nature of this market and the broker dealer, it is imperative that you are working with an insurance broker who specializes in your particular industry or line of coverage. Gallagher has a vast network of specialists who understand your industry and business, along with the best solutions in the marketplace for your specific challenges. It is extremely important to start renewals as soon as possible, working with your Gallagher team with dedicated expertise in this space to deliver a comprehensive and professional submission to underwriters.

Please note: A client's risk profile is the primary variable dictating renewal outcomes. Loss experience, industry, location and individual account nuances will also have a significant impact on these renewals.

2021 Adviser Benchmarking

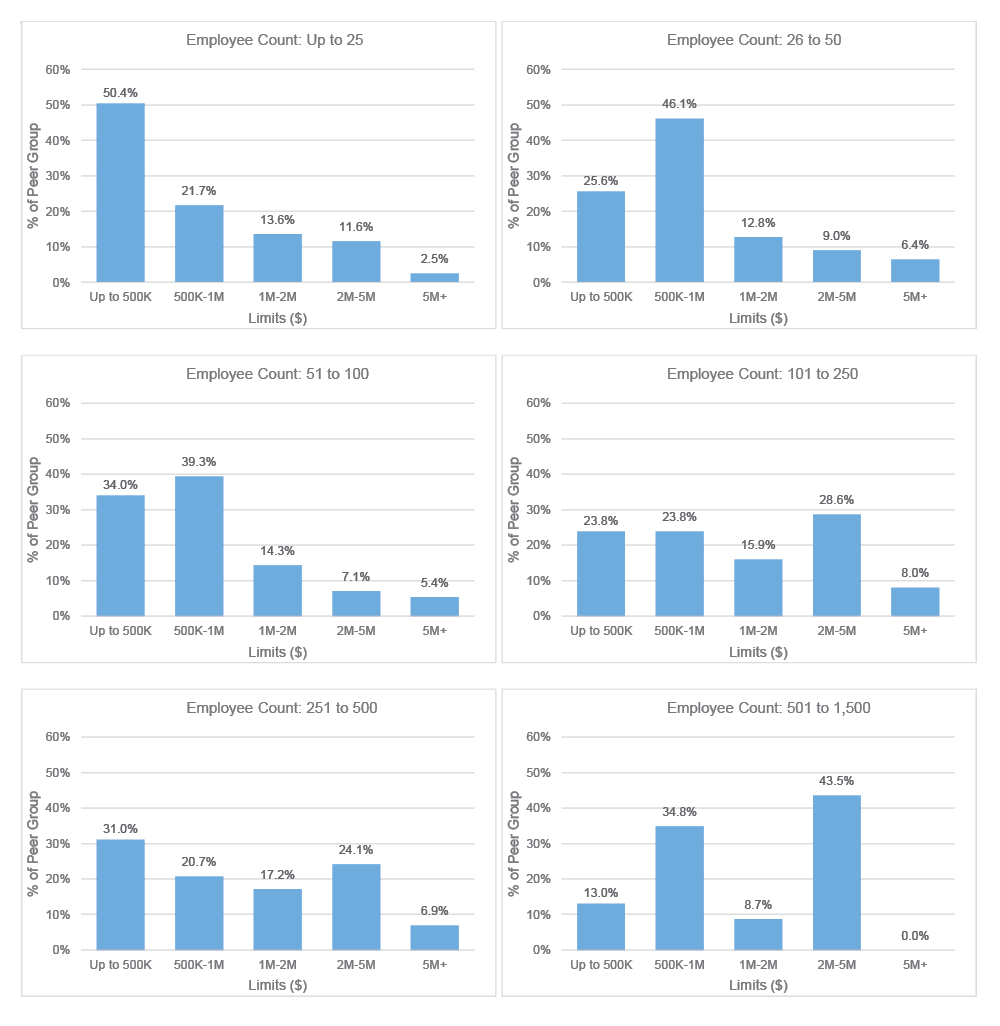

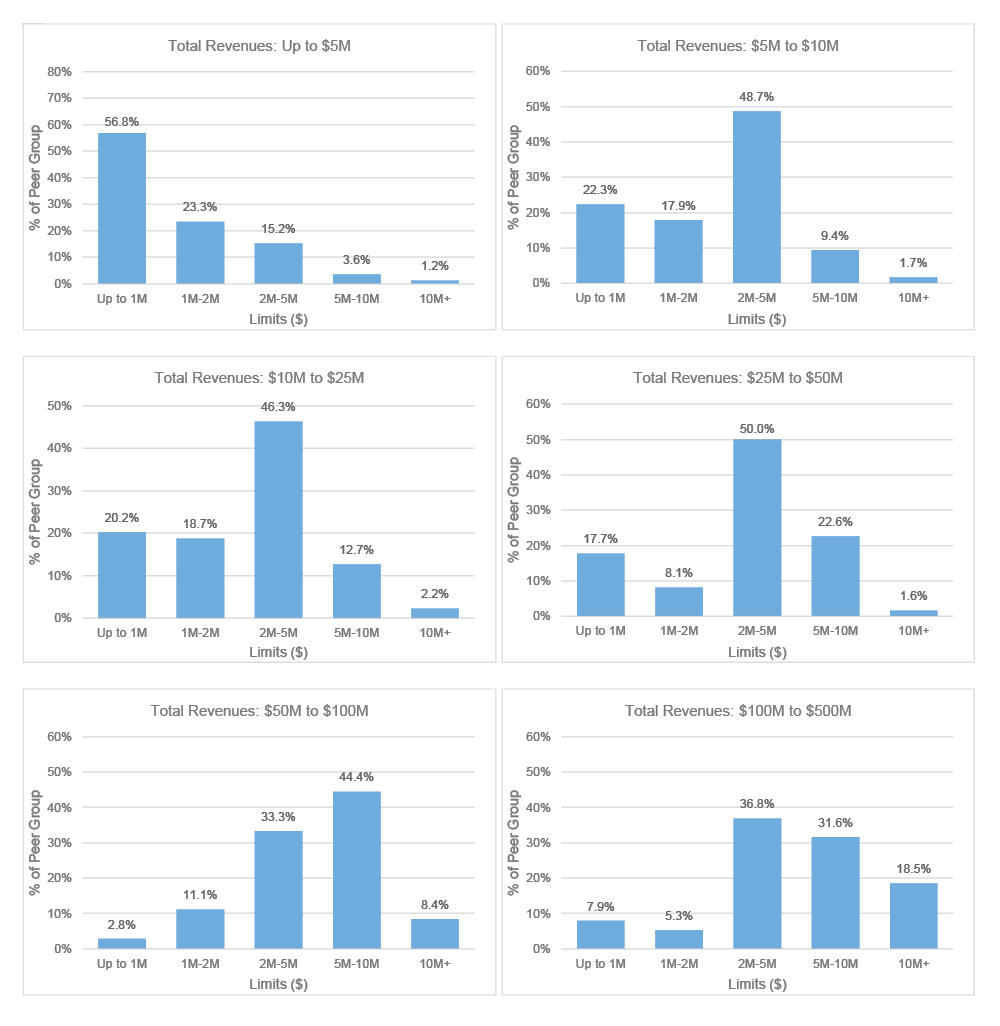

Nonprofit Sector D&O Limits of Liability

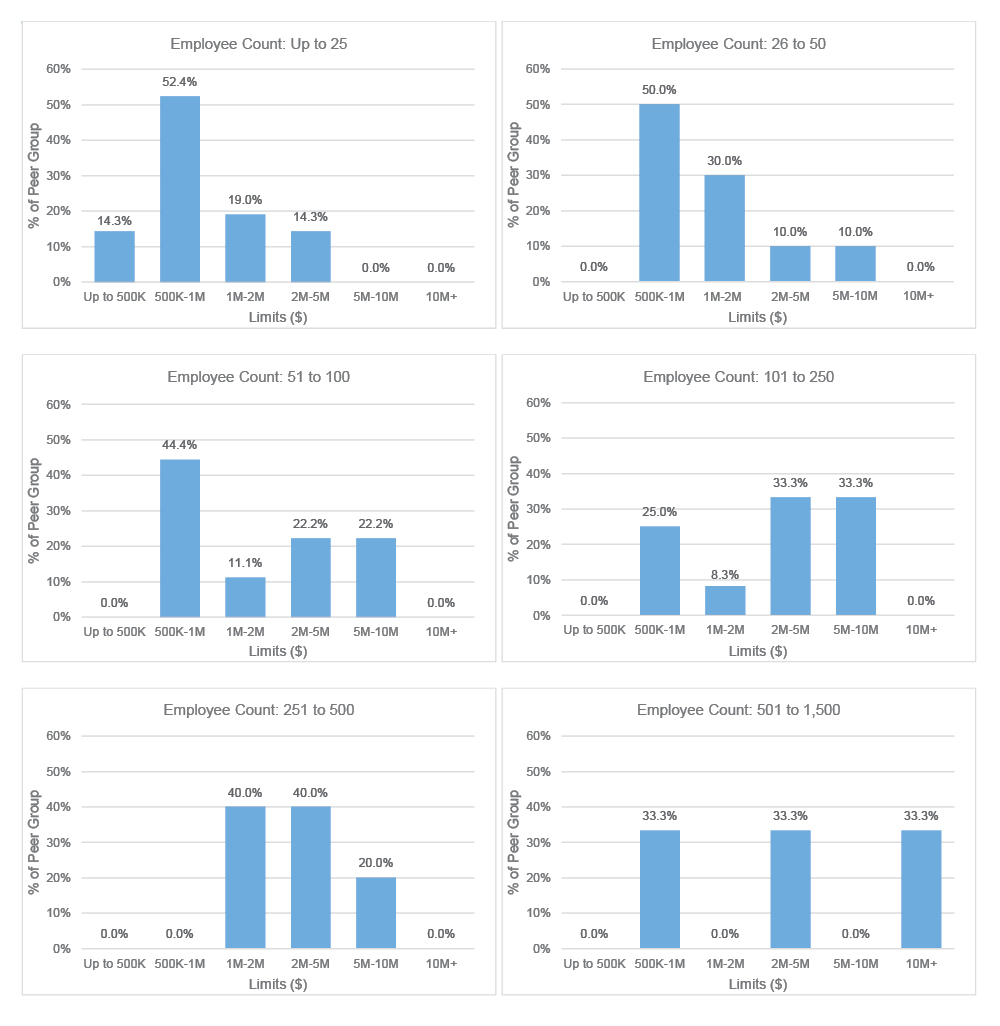

Nonprofit Sector EPL Limits of Liability

Nonprofit Fiduciary Limits of Liability

Nonprofit Sector Crime Limits of Liability